Representative Brian Rea Submits Estate Tax Reform Bill

BRIAN REA

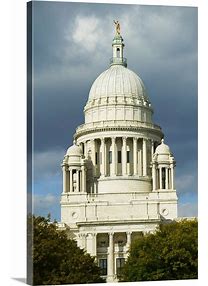

State House, Providence – Rhode Island House Representative Brian Rea (D 53) introduced legislation (LC004847) to incrementally increase Rhode Island’s estate tax exemption threshold until it is equal to the federal estate tax exemption, which is projected to be $13.61M in 2024.

Rhode Island has one of the most aggressive estate taxes in the region. In 2023, Rhode Island only exempted the first $1.7M of an estate. Beyond that point, the estate is taxed on a sliding scale of 0.8% – 16% based on the value of the estate after the exemption is applied. Introducing this legislation to increase the exemption threshold not only helps Rhode Island retirees, but also protects families of small business owners, whose assets on paper may put them beyond the exemption limit — creating a financial burden on the surviving family members, who may have to sell off assets to be able to pay the associated tax.

“It is a disservice to the people of Rhode Island for the government to tax what has been gained during a lifetime of hard work,” said Representative Rea. “While paying taxes is our responsibility, double taxing decedents’ property is not only improper –some might say it is outright criminal. Rhode Island is among 12 or so states who still apply an estate tax. Maintaining this type of revenue stream is not forward-thinking, as it creates an exodus of knowledge and experience within our well-to-do and senior populations. It can also be argued that this tax stifles economic growth and suppresses wages.”