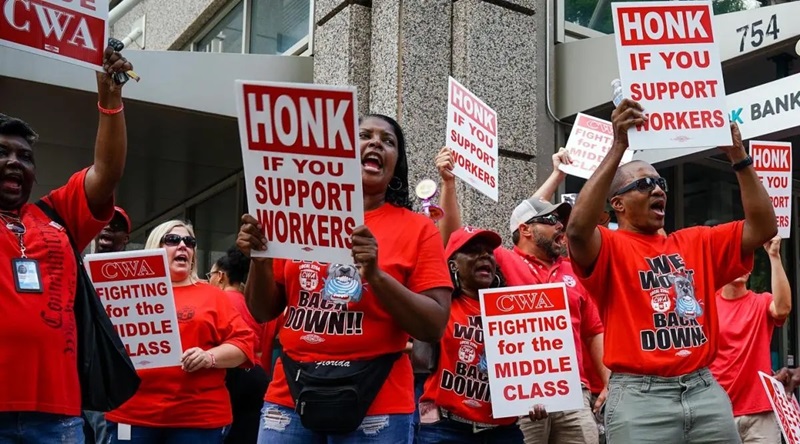

Labor groups push to end tax breaks for union-busting

Kathryn Carley – Commonwealth News Service

New federal legislation would prevent companies from getting a tax break for engaging in what are often illegal union-busting tactics.

Labor groups say companies spend millions of dollars on hired consultants who threaten workers with termination for exercising their right to unionize, then claim the cost of those consultants as a standard business tax write-off

Elena Lopez, senior legislative specialist for the Communications Workers of America, said as workers are organizing for better wages and working conditions, taxpayers are subsidizing the efforts to stop them.

“Companies are actively breaking the law,” Lopez asserted. “And they’re being rewarded for breaking the law.”

Lopez pointed out workers do not get a tax break for their union dues, and companies’ anti-union campaigns should also be classified as non-tax-deductible, the same as lobbying or corporate political speech.

Labor advocates say the legislation to change the tax code builds on the public’s growing approval of unions, now at a 50-year high.

Steve Striffler, director of the Labor Resource Center at the University of Massachusetts-Boston, said the pandemic highlighted the struggles of many essential workers and the country’s extreme income inequality.

“I think working people realized how exposed they were — often how little employers seemed to care about their safety, and their general well-being — as workplaces shut down,” Striffler observed. “In other cases, the work itself became sort-of very dangerous.”

Striffler added efforts to organize workers at various Starbucks and Trader Joe’s locations in Massachusetts are part of the nationwide trend in union growth. Changing the tax code would not alleviate all the challenges to workers, he said, but could help level the playing field.