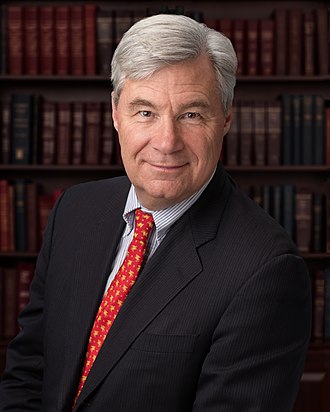

Whitehouse and DelBene Reintroduce Carbon Border Adjustment Bill to Boost Domestic Manufacturers and Tackle Climate Change

Clean Competition Act would lower emissions across high-polluting sectors at home and abroad.

Washington, D.C. – U.S. Senator Sheldon Whitehouse (D-RI) and Congresswoman Suzan K. DelBene (D-WA-01) today reintroduced the Clean Competition Act, legislation aimed at making American companies more competitive in the global marketplace and tackling major sources of planet-warming greenhouse gas emissions by creating a carbon border adjustment. The legislation is cosponsored by U.S. Senators Brian Schatz (D-HI) and Martin Heinrich (D-NM) in the Senate and Representatives Don Beyer (D-VA-08), Kathy Castor (D-FL-14), and Ami Bera, M.D. (D-CA-06) in the House of Representatives.

“American manufacturers doing the right thing on climate are at a disadvantage compared to high-polluting foreign competitors,” said Whitehouse. “Our Clean Competition Act would give domestic companies a step up in the global marketplace while lowering carbon emissions at home and abroad, and ultimately steering the planet toward climate safety. There is bipartisan momentum for a carbon border adjustment in the Senate – this is a solution endorsed by industry and experts across the political spectrum.”

“For too long, American industries producing goods in a less carbon-intensive way have been undercut by foreign competitors with dirtier production processes. Washington saw this firsthand with the closure of the Intalco aluminum smelter due to China’s overproduction, which resulted in the loss of over 700 good-paying union jobs. To address the climate crisis while defending American industries, the Clean Competition Act would impose a fee on imports from high-carbon emitting producers,” said DelBene. “A carbon fee would incentivize industries from around the world to prioritize decarbonization and create a level playing field for American workers in these sectors.”

A carbon border adjustment mechanism is an environmental trade policy that includes charges on imports from particularly carbon-intensive manufacturers.

“Thank you, Senator Whitehouse and cosponsors for your leadership in introducing the Clean Competition Act. Holcim is on a mission to decarbonize building across its entire lifecycle to build a net-zero future that works for people and the planet. The Clean Competition Act recognizes and rewards strong environmental performance, and ensures that innovation in environmental protection only strengthens our competitive edge,” said Melissa Carey, Head of Climate, ESG Policy and Government Affairs for Holcim US, one of the world’s largest cement and building materials company.

“A carbon border adjustment mechanism would bring substantial climate, manufacturing, national security, and geopolitical benefits to the U.S. and its economy, while cementing America’s global leadership in clean industry and environmental stewardship,” said Zach Friedman, director of federal policy, Ceres. “This pro-growth, market-based policy has the support of U.S. companies, and it will encourage businesses around the world to cut pollution that harms the climate and risks economic growth. It also presents a major opportunity to continue the boom in clean technology investment, bringing new economic opportunities across the U.S. while reducing pollution in the communities suffering the most from environmental damage both domestically and around the world. We are grateful to Senator Whitehouse for introducing this bill to ensure U.S. trade policy does not give polluters an unfair advantage. We urge lawmakers of both parties to negotiate a bipartisan bill to pass this Congress, giving America’s businesses and workers a level playing field to compete and win the global race to build an abundant clean energy future for all.”

“Manufacturing accounts for nearly one-quarter of U.S. climate pollution and is a rapidly growing sector globally. Reducing climate pollution is vital for a stable climate and healthy, thriving communities. The Clean Competition Act can create a race to the top among global competitors as part of a larger effort to move toward a low-carbon economy, while opening a dialogue about additional efforts needed to address local pollution impacts on frontline communities,” said Elizabeth Gore, Senior Vice President for Political Affairs at Environmental Defense Fund.

“Thanks to a provision to reinvest revenue in domestic decarbonization projects, the bill incentivizes U.S. producers to become as clean and competitive as possible. By prioritizing investments toward greatest emission reductions, polluting facilities affected by the fee stand to gain most, as do communities hit hardest by pollution,” said Harry Manin, Deputy Legislative Director for Industrial Policy and Trade at the Sierra Club. “With China’s Belt and Road Initiative floundering, we can supplant the financing of carbon-intensive manufacturing and fossil fuel projects around the world. By offering an alternative path for Least Developed Countries, climate-forward trade bills like the Clean Competition Act are important opportunities to assert American global leadership.”

“The Clean Competition Act is a thoughtful proposal that leverages trade policy as a tool to tackle global emissions from industrial sectors. This proposal aims to send a powerful market signal to the international trading system, harnessing America’s Carbon Advantage in support of U.S. climate, economic, and geopolitical objectives. Efforts to address the emissions embodied in trade, particularly among hard to decarbonize industrial sectors, are a crucial step toward enhancing American competitiveness while lowering global emissions. The Council appreciates Senator Whitehouse and Representative DelBene and their cosponsors and the growing number of members on both sides of the aisle, for their thoughtful exploration of climate and trade policies,” said Climate Leadership Council CEO Greg Bertelsen.

“In the face of a worsening climate crisis, it is clear that we must accelerate our transition to a cleaner economy. The Clean Competition Act will speed that progress by supporting the American manufacturing sector’s transition to cleaner production, while investing in domestic manufacturing and jobs,” said Shannon Heyck-Williams, Associate Vice President of Climate and Energy at the National Wildlife Federation. “We applaud the efforts of Senator Whitehouse and Representatives DelBene and Castor to protect people and wildlife from climate altering pollution and keep us on track for our mid-century decarbonization goals.”

“Senator Whitehouse’s Clean Competition Act represents a promising approach to address climate pollution in the industrial sector,” said C2ES President Nat Keohane. “By imposing a fee on imports of carbon-intensive goods while rewarding cleaner production here at home, the proposal would ensure a level playing field for U.S. manufacturers and help safeguard their long-term competitiveness in a low-carbon economy. We look forward to continue working with Congress, companies, and other stakeholders, to help build bipartisan support for a well-designed border adjustment that ensures greater domestic ambition alongside international partnerships that can drive global emission reductions.”

The Clean Competition Act would impose a carbon border adjustment on energy intensive imports, while incentivizing decarbonization of domestic manufacturing. Starting in 2025, the adjustment would apply to energy intensive industries, including fossil fuels, refined petroleum products, petrochemicals, fertilizer, hydrogen, adipic acid, cement, iron and steel, aluminum, glass, pulp and paper, and ethanol. In 2027, it would be expanded to include imported finished goods that meet certain weight or value thresholds.

For imports manufactured in opaque economies, the levy would be calculated based on the ratio of the country of origin’s economy-wide carbon intensity to the U.S. economy-wide carbon intensity. For imports manufactured in transparent economies with reliable, verifiable data, the levy would be calculated based on the country of origin’s relevant industry-specific average carbon intensity; foreign manufacturers in such economies could petition to use their own carbon intensities. Importers would only pay the levy based on the fraction of emissions that exceeds the applicable U.S. carbon intensity baseline. In 2025, the U.S. carbon intensity baseline for each industry is set at their average carbon intensity. From 2026 through 2029, the applicable U.S. carbon intensity baselines would be reduced by 2.5 percentage points each year from the initial average. Starting in 2030, the baselines would decrease by 5 percentage points per year. The levy would begin at $55 per ton and increase at 5 percent above inflation per year. Covered imports from least developed countries would be exempt from any charges, unless they hold a significant share of the market in question.

Covered domestic manufacturers include any facilities producing the same energy intensive primary goods covered under the initial phase of the border adjustment that are also required to report GHG emissions under EPA’s Greenhouse Gas Reporting Program (GHGRP). Such facilities would be required to report GHGRP data to Treasury, as well as their annual electricity consumption and annual production of any covered primary goods by weight. Treasury would use these to calculate the initial U.S. carbon intensity baseline, covering scope one and two emissions, for each energy intensive industry. Industry boundaries are drawn by Treasury, based on six-digit North American Industry Classification System (NAICS) codes.

Starting in 2025, covered facilities whose carbon intensity is calculated to be at or below the applicable industry carbon intensity baseline would pay nothing; covered facilities whose carbon intensity is above the applicable industry carbon intensity baseline would pay the levy only on the fraction of emissions that exceeds the industry baseline. For NAICS codes that cover a heterogeneous group of goods, a manufacturer may petition Treasury to calculate a good-specific average carbon intensity. Refunds will be issued for covered and finished goods that are exported.

Seventy-five percent of revenues raised each year would fund a competitive grant program for each of the covered industries that would help invest in the new technologies necessary to reduce their carbon footprints. The new grant program would be modeled on the Diesel Emissions Reduction Act (DERA) Program and administered by Treasury with support from the Department of Energy and the Environmental Protection Agency. Twenty-five percent of revenues raised would be deposited in a fund administered by the State Department to help developing countries decarbonize.

Text of the bill is available here.