Advocates: Public Banking Could Reboot Post-COVID-19 Economy

Suzanne Potter – Commonwealth News Service

BOSTON — Advocates for public banking are pressing states to create their own banks, which could lend at lower rates and prioritize the recovery of local business.

They argue that Wall Street currently takes too big a bite in fees and interest.

Ellen Brown, chair of the nonprofit Public Banking Institute, says states should move their money to state entities that act like a utility whose mission is to promote the public interest.

“They can direct it to the people and businesses in their local communities that actually need it,” she explains. “Right now that credit power is all going to Wall Street, which is not redirecting it back into our local communities.”

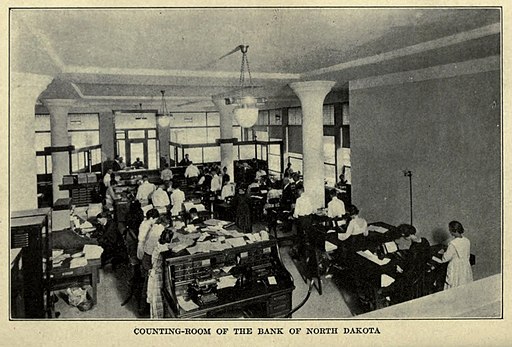

Right now the 100-year-old, highly profitable Bank of North Dakota is the only state-owned bank in the country.

A bill currently before the Massachusetts legislature would create the Massachusetts Infrastructure Bank solely to make low-interest loans for things such as roads, bridges and water systems.

Opponents of public banking say it is too risky and assert that government competition would undermine the system of privately owned banks.

Brown says the idea of public banking is gaining steam in the wake of the financial crisis caused by COVID-19 lock downs.

“It’s a time when we could bypass a lot of those barriers that are put up really by vested interests that don’t really want to see a public banking model that will compete with their private models,” she states. “What we need is the political will, and emergencies will give us the political will.”

The Public Banking Institute would also like Congress to empower the Postal Service to set up its own bank. This would bring back an option that Americans enjoyed from 1911 to 1967 — affordable checking and savings accounts that would be accessible from a counter in each local post office.